Contents

- 1 Texas's Record-Breaking Economic Achievements

- 2 The Rise of Texas as a Financial and Capital Markets Leader

- 3 Infrastructure, Talent, and International Investment Opportunities

- 4 Spotlight on Leadership and Action Items

- 5 Why This Matters for American Katerra and the Future of Texas Economic Development

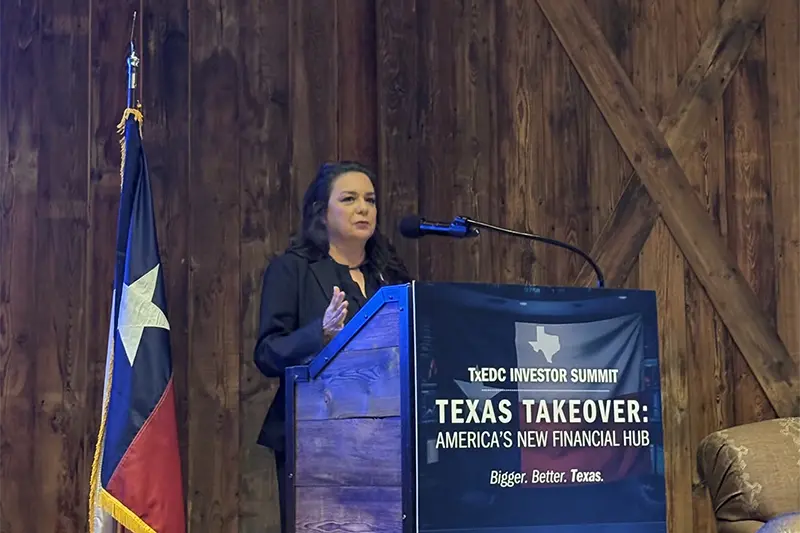

On September 24, 2025, we had the privilege of attending the Texas Economic Development Corporation (TxEDC) Investor Summit at Circle T Ranch in Westlake, Texas. Themed “Texas Takeover: America’s New Financial Hub,” this event brought together industry leaders, policymakers, and investors to discuss the Lone Star State’s explosive growth in finance, technology, and economic development. As a representative of American Katerra, a leader in innovative steel fabrication provider, we were eager to explore how Texas’s economic momentum could drive opportunities in the steel fabrication sector. We share key highlights from the summit, including insights that underscore why Texas is poised to dominate as the nation’s financial epicenter.

Texas's Record-Breaking Economic Achievements

The summit kicked off with a strong emphasis on Texas’s unparalleled economic performance. According to Ms. Adriana Cruz, Executive Director, Governor’s Texas Economic Development & Tourism Office Texas, has maintained its spot as the #1 state for business for 22 consecutive years. Last year alone saw 1,300 new corporate facility projects, promising $31 billion in capital investment and over 30,000 new jobs. This builds on a 13-year streak of winning the Governor’s Cup for the most corporate relocations and expansions.

Key highlights included:

- Financial Services Boom: Texas now hosts nearly 50,000 financial firms and the largest financial services workforce in the U.S. (650,000 employees), surpassing New York with a 46% job growth since 2010.

- Major Corporate Moves: Companies like Scotiabank (opening a Dallas office with 1,000+ jobs and $60 million investment), Charles Schwab, CBRE, Eli Lilly (new Houston facility), OpenAI, and Oracle (Abilene announcements) are flocking to the state.

- Alliance Corridor Success: This 27,000-acre development houses 600+ firms, employs 66,000 workers, and has generated $130 billion in economic impact, with tenants like Fidelity, Deloitte, and Facebook’s $2 billion data center.

This influx of corporate relocations means surging demand for advanced manufacturing facilities, data centers, and office spaces. Our modular steel fabrication expertise could play a pivotal role in scaling these projects efficiently and sustainably.

The Rise of Texas as a Financial and Capital Markets Leader

A major focus was Texas’s transformation into a financial hub, with panels on the Texas Stock Exchange (TXSE), NYSE Texas, and Nasdaq expansions. The TXSE, set to launch in early 2026 with backing from BlackRock and Citadel Securities, aims to be “issuer-friendly” with lower costs and streamlined regulations.

NYSE Texas, operational since March 2025, already lists 49 companies and 14 ETF providers, serving as a southern U.S. hub. Nasdaq is expanding in Dallas to support 220+ Texas clients, focusing on anti-financial crime tech.

Legislative wins bolstering this include:

- Pro-Business Laws: SB 29 enhances protections for corporate directors and adds proxy advisor accountability.

- Constitutional Amendments: Bans on capital gains, estate, and stock transaction taxes.

- Business Court System: Specialized courts for corporate litigation, reducing risks and attracting reincorporations from Delaware.

Venture capital and private equity discussions highlighted over $150 million invested in 2025, with half targeting Texas tech firms. Panelists like Mr. Doug Deason (Deason Capital Services) and Mr. Spencer Kaye (Transform Investments) emphasized Texas’s relationship-focused culture, family offices, and talent pool from 16 tier-one universities.

For American Katerra, these developments signal opportunities in building financial infrastructure, such as data centers and AI facilities, where our sustainable buildings’ steel fabrication methods can support Texas’s $140 billion infrastructure investments over the next decade.

Infrastructure, Talent, and International Investment Opportunities

Texas’s edge in infrastructure was a recurring theme. The state leads in power generation—producing more electricity than the next two states combined—with a diverse mix of wind, solar, nuclear, natural gas, and oil. This low-cost, reliable energy is attracting AI giants, including the massive Stargate AI data center in Abilene and undisclosed larger projects.

Talent development is equally robust:

- 92% high school graduation rate in North Texas.

- Reforms in community college funding tied to job outcomes.

- Over 650,000 financial services professionals.

Internationally, Texas attracts $1.6 trillion in potential investments from South Korea ($350 billion), Japan ($550 billion), and Europe ($750 billion). Trade offices in Mexico and Taiwan, with expansions to the UK and Israel, strengthen global ties. Texas is also #1 in semiconductor manufacturing, with $44 billion Samsung and TSMC facilities under construction.

As American Katerra focuses on eco-friendly building, we’re excited about contributing to Texas’s water ($20 billion), transportation, and grid enhancements, especially for AI and data center expansions.

Spotlight on Leadership and Action Items

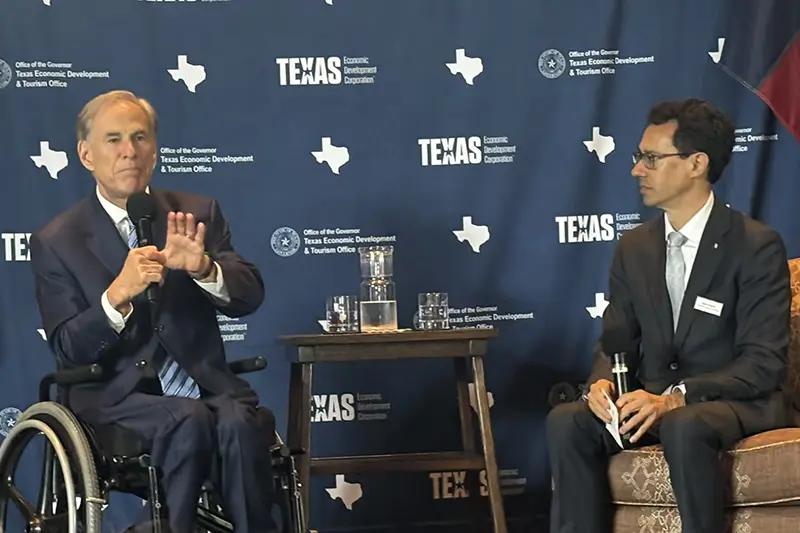

Governor Greg Abbott’s fireside chat, moderated by Glenn Hamer (Texas Association of Business), reinforced Texas’s leadership. He highlighted 2.5 million jobs added, a 15 million-strong workforce, and initiatives like the Texas Cyber Command and Army Futures Command in Austin.

Notable appointments included Amar Gain as Ambassador for World Cup initiatives in Houston and Dallas, emphasizing Texas’s global event prowess.

Action items from the summit:

- Continue global marketing to attract international investment (@TxEDC).

- Ensure passage of tax-banning amendments (@State Leadership).

- Support TXSE launch and attract financial firms (@Business Community).

- Invest in grid and transportation for AI growth (@Infrastructure Teams).

Why This Matters for American Katerra and the Future of Texas Economic Development

Attending the TxEDC Investor Summit reaffirmed Texas’s trajectory as America’s financial hub. For American Katerra, this means aligning our steel fabrication innovations with the state’s growth in tech, finance, and infrastructure. Whether it’s prefabricated data centers or sustainable office builds, we’re ready to partner in building a bigger, better Texas.

If you’re in the steel industry, real estate, or economic development, events like this highlight why Texas is the place to invest. Stay tuned for more updates from American Katerra on how we’re contributing to this takeover.